Bridging loans are a specialised financial solution designed to help individuals and families manage the gap between selling an existing property and purchasing a new one. Whether you’re upgrading your home, downsizing, or venturing into property investment, understanding how bridging loans work can make your transition smoother and more financially viable.

What is a Bridging Loan?

A bridging loan is a short-term loan that allows you to finance the purchase of a new property while you wait for your current property to sell. It “bridges” the financial gap, ensuring you don’t miss out on opportunities in a competitive property market.

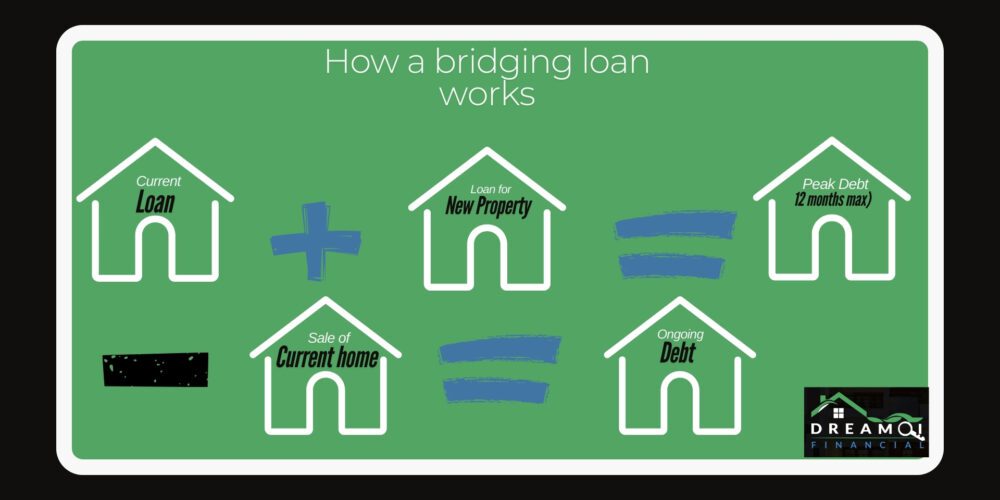

How Do Bridging Loans Work?

- Loan Structure:

- A bridging loan typically combines your existing mortgage and the new loan into a single facility.

- The loan is interest-only during the bridging period, which can range from a few months to a maximum of 12 months (varies by lender).

- Repayment:

- Once your current property sells, the proceeds are used to pay off the bridging loan.

- If there’s a remaining balance, it converts into a standard home loan.

- Eligibility:

- Lenders assess your ability to service the debt during the bridging period based on your income, assets, and liabilities.

Benefits of Bridging Loans

- Flexibility:

- Allows you to purchase a new property without waiting for your current property to sell.

- 🛀Stress Reduction:

- Eliminates the need to synchronise settlement dates, giving you more control over the buying and selling process.

- Opportunity to Maximise Value:

- Provides time to secure a higher price for your current property rather than rushing a sale.

Choosing the Right Bridging Loan

When selecting a bridging loan, consider the following:

- Interest Rates:

- Compare rates across lenders to ensure you’re getting competitive terms.

- Fees:

- Check for establishment fees, exit fees, and any other associated costs.

- Loan Terms:

- Review the maximum bridging period allowed and any conditions tied to the loan.

- Lender Experience:

- Work with lenders who have experience in offering bridging loans and can guide you through the process.

Why Now is a Great Time for Investors

The Australian housing market has experienced stabilisation in house prices, with many cities showing signs of growth. Low housing supply coupled with strong demand makes it a favourable time for property investors. Bridging loans allow you to seize opportunities quickly in this dynamic market.

FAQs About Bridging Loans

1. How is the interest calculated on a bridging loan?

Interest is usually calculated on the outstanding balance of your total debt (existing loan and new loan) during the bridging period. Most lenders offer interest-only repayments during this time.

2. What happens if my property doesn’t sell within the bridging period?

If your property doesn’t sell within the agreed timeframe, you may need to negotiate an extension with your lender or refinance into a long-term loan.

3. Can I use a bridging loan for an investment property?

Yes, bridging loans can be used for purchasing investment properties, provided you meet the lender’s criteria.

4. Are bridging loans more expensive than standard home loans?

Bridging loans often have higher interest rates and fees due to their short-term nature. However, the convenience and flexibility they provide can outweigh the costs.

5. How do I know if a bridging loan is right for me?

Consult a mortgage broker who can assess your financial situation and recommend the best solution tailored to your needs.

Why Choose DreamQi Financial?

At DreamQi Financial, we specialize in helping clients navigate the complexities of bridging loans. With over a decade of experience in credit and lending, we ensure you receive personalized advice and access to the most competitive products in the market.

Get in Touch Today!

Ready to explore bridging loans? Contact DreamQi Financial for expert guidance and a seamless borrowing experience.

This Post Has 0 Comments